News

11 items found

-

Seminar -

Seminar CLE Seminar: Mérő Bence

Milano - 07 maggio 2025 -

Seminar CLE Seminar: Gabriele Iannotta

Milano - 21 marzo 2025 -

Seminar CLE Seminar: Marco Le Moglie

Milano - 21 febbraio 2025 -

Seminar CLE Seminar: Elisa Palagi

Milano - 07 febbraio 2025 -

Seminar CLE Seminar: Aldo Glielmo

Milano - 13 dicembre 2024 -

Research New Working Paper

01 dicembre 2024 -

Presentazione volume Presentazione libro di Pier Giorgio Ardeni e Mauro Gallegati

Milano - 12 novembre 2024 -

Seminar CLE Seminar: Andrea Colciago

Milano - 18 ottobre 2024 -

Annual Lecture 9th CLE Annual Lecture by Mordecai Kurz

Milano - 24 settembre 2024 -

Seminar CLE Seminar: Massimo Ferrari Minesso

Milano - 17 settembre 2024

Foto e video

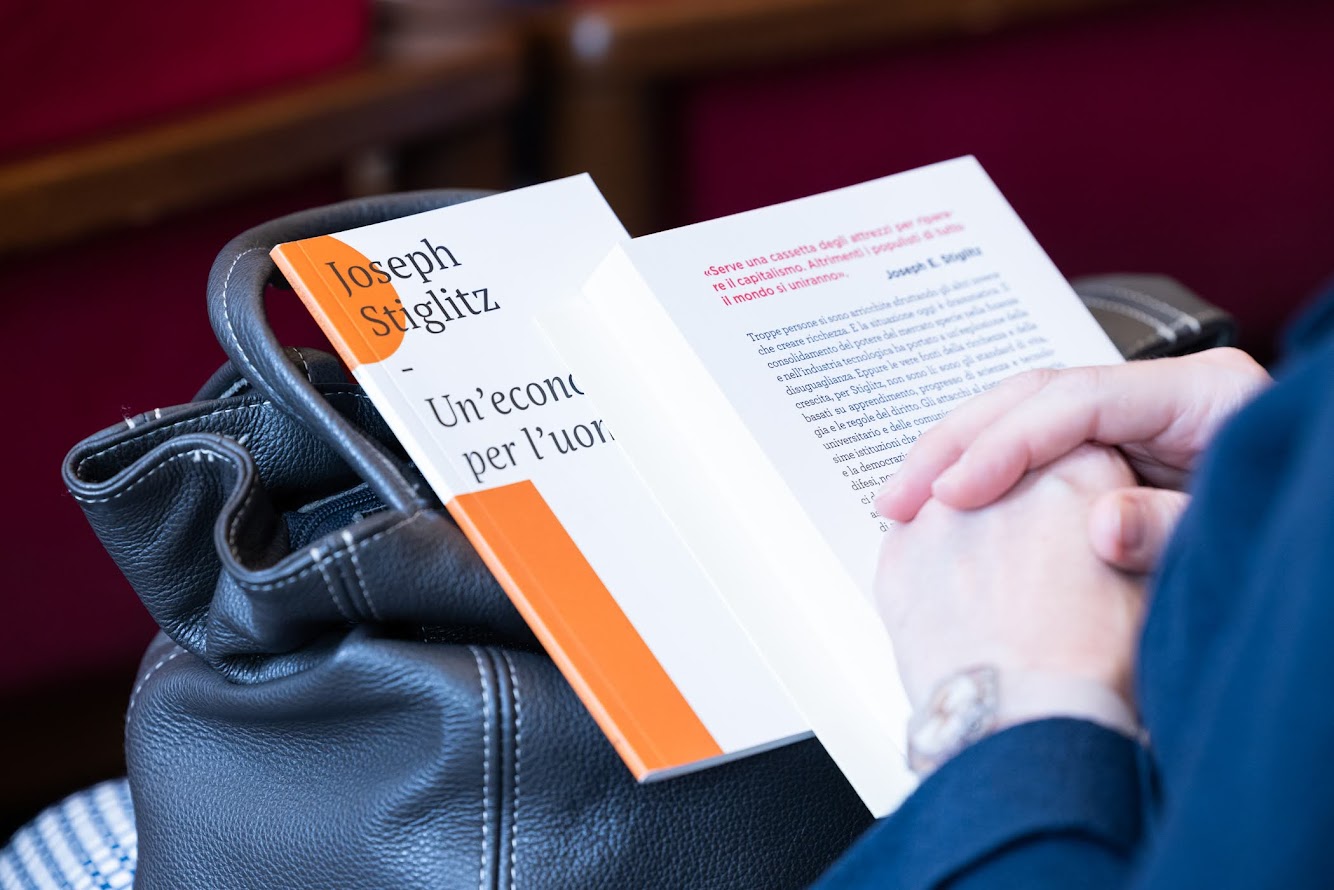

Interviste a: Jospeh Stiglitz (CLE Annual Lecture 2015 e 2023), Mordecai Kurz (CLE Annual Lecture 2024)

Stiglitz, CLE Annual Lecture, 8/6/2015

Stiglitz, CLE Annual Lecture, 24/5/2023

Kurz, CLE Annual Lecture, 24/9/2024

8th CLE Annual Lecture 2023: J.E. Stiglitz (Columbia University), "An economy for a just, free and prosperous society "